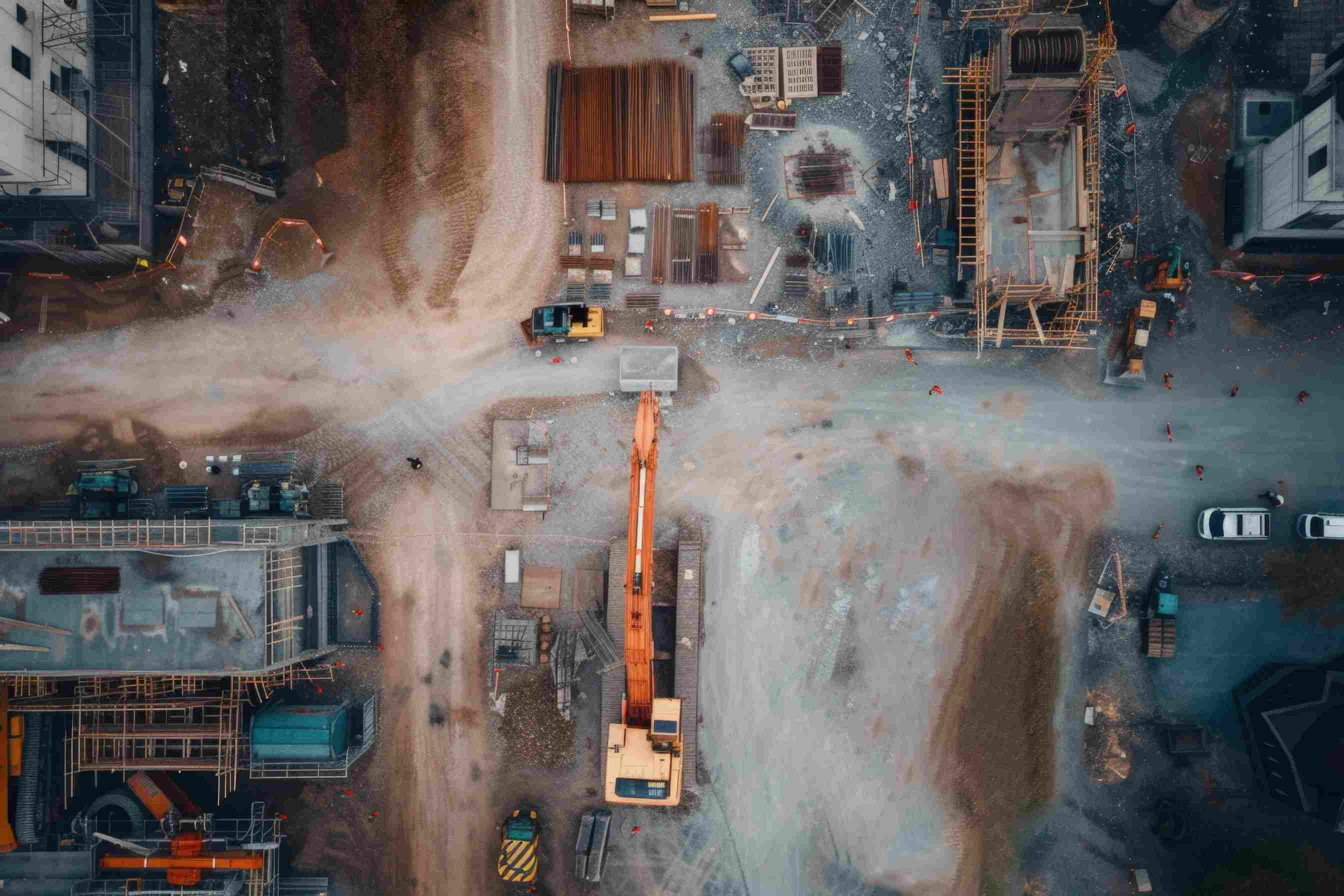

أنا. مقدمة: الأداء غير المتكافئ من منظور عالمي

في النصف الأول من عام 2025، أظهرت شركات معدات البناء العالمية سماتٍ رائعةً من الاستقرار القياسي مع التمايز الإقليمي. عالميًا، ظل الطلب في السوق ككل مستقرًا للغاية؛ ومع ذلك، تباين الأداء الإقليمي بشكل كبير، حيث شهد بعضها نموًا بطيئًا بينما أظهر البعض الآخر زخمًا قويًا. هذا الأداء غير المتوازن جعل تقلبات السوق الإقليمية عاملًا رئيسيًا يتعين على العديد من شركات معدات البناء مراعاته بعناية خلال نموها وتوسعها في الأسواق البعيدة. وقد برزت معرفة نبض كل سوق إقليمي بدقة كتحدي جوهري للشركات لتحقيق نمو مستدام.

ثانيًا: تحليل المناطق التي تشهد تباطؤًا في النمو (الممثلون النموذجيون: الهند، وأوروبا، والولايات المتحدة)

2.1 السوق الهندية - من النمو المرتفع إلى الركود

في السنة المالية 2024-2025 (FY25)، لم تتجاوز نسبة نمو الإيرادات في سوق آلات التطوير الهندية 3%، وهو انخفاض قياسي يتناقض بشكل صارخ مع زخم الازدهار الكبير في السنوات القليلة الماضية. وقد شهدت مبيعات المعدات التي كانت مطلوبة بشدة سابقًا، مثل كبير الحفارات (أكثر من 20 طنًا) و trرافعات uck (50 طنًا)، تشهد الآن انخفاضًا كبيرًا.

يُظهر التقييم المُعمّق للعوامل الأساسية التأثير الكبير لدورة الانتخابات. فقد أدى التأخير في بدء العديد من مشاريع البناء إلى انخفاض ملحوظ في الطلب الفوري على معدات البناء. علاوة على ذلك، حال تجميد تمويل البنية التحتية دون إنجاز العديد من مشاريع البنية التحتية المُخطط لها كما هو مُخطط لها، بالإضافة إلى انخفاض الطلب على المعدات. علاوة على ذلك، أدى تباطؤ سلسلة الرسوم من شركات التطوير إلى إجهاد سلاسل رأس المال لديها، مما جعل من الصعب الاستثمار في معدات بناء جديدة، مما أعاق نمو السوق بشكل كبير.

أدى تباطؤ السوق إلى معاناة المصنّعين الأجانب من تراكم كبير في المخزون، مع وجود كميات هائلة من الأدوات غير المباعة، مما أدى إلى استنفاد رأس المال وموارد التخزين الضخمة. كما اختارت الوكالات المحلية تقليص عمليات الإرجاع لمواجهة حالة عدم اليقين في السوق والضغوط التشغيلية.

2.2 الأسواق الأوروبية والأمريكية - الحذر

يهيمن الحذر على أسواق آلات البناء الأوروبية والأمريكية. وتتوقع معظم شركات تصنيع المعدات الأصلية، مثل فولفو، بقاء السوق مستقرًا طوال عام 2025، مما يشير إلى ضعف واضح في زخم النمو. ومن الأسباب الرئيسية لهذا الوضع ما يلي:

لقد تباطأ معدل نمو مشاريع البناء بشكل كبير، مع انخفاض كل من عدد وحجم المشاريع التي بدأت، سواء في مجال البنية التحتية أو تطوير العقارات.

وقد أدت الضغوط التضخمية المستمرة إلى ارتفاع تكاليف الإنتاج والتشغيل لمعدات البناء، مما أدى إلى الضغط على هوامش الربح للشركات.

لقد أدت بيئة التمويل الضيقة إلى جعل من الصعب بشكل متزايد على الشركات ومقاولي البناء الحصول على التمويل، مما أعاق تحديث المعدات وخطط الشراء.

في ظل هذه البيئة السوقية، برزت اتجاهات جديدة. يزداد رواج نموذج الإيجار المنتهي بالشراء، حيث تتجه المزيد من الشركات إلى استئجار المعدات لتلبية احتياجاتها قصيرة الأجل، مما يُخفف الضغط المالي وخطر تعطل المعدات. أما المعدات الأصغر حجمًا، مثل حفارات صغيرة من 1 إلى 3 أطنان و الرافعات الشوكية الكهربائيةوقد حافظت على طلب مستقر نسبيًا بفضل مرونتها وقدرتها على التكيف، مما يجعلها نقطة مضيئة في السوق.

ثالثًا: تحليل المناطق سريعة النمو (الممثلون النموذجيون: الصين وجنوب شرق آسيا)

3.1 السوق الصينية - انتعاش مدفوع بتعافي البنية التحتية

في النصف الأول من عام 2025، شهد دخل المنازل في سوق معدات البناء في الصين انتعاشًا كبيرًا، مدفوعًا بشكل رئيسي بالاستثمارات الحكومية القوية في البنية التحتية والتطور السريع لمشاريع الطاقة الخضراء. وقد أدى التقدم التدريجي في سلسلة من مشاريع البنية التحتية المهمة، مثل الطرق السريعة والسكك الحديدية ومشاريع الحفاظ على المياه، إلى زيادة ملحوظة في الطلب على معدات البناء.

بفضل الطلب في السوق، حققت بعض أنواع المنتجات الشهيرة أداءً جيدًا إلى حد كبير. الرافعات الشوكية الكهربائية, محبوبة من قبل الصناعات مثل التخزين والخدمات اللوجستية بسبب ملاءمتها للبيئة وكفاءتها؛ حفارات صغيرة وقد لاقت الرافعات متعددة الأغراض، التي تتراوح سعتها بين 1 إلى 6 أطنان، بفضل مرونتها وراحتها، طلباً قوياً في بناء المدن وإعادة الإعمار الريفي؛ كما استجابت الرافعات متعددة الأغراض، بوظائفها المتنوعة، لرغبات العديد من سيناريوهات التطوير، مما أدى إلى طفرة مستمرة في المبيعات.

في الوقت نفسه، أصبحت الصادرات محركًا رئيسيًا لازدهار سوق معدات البناء في الصين. حفارات 20 طنًا و رافعات شوكية كهربائية سعة 5 أطنان وقد شهدت الصادرات الصينية زيادة ملحوظة في جنوب شرق آسيا وأميركا اللاتينية ومناطق مختلفة، مما يدل على التحسن المستمر في القدرة التنافسية العالمية للصين في آلية التنمية.

3.2 سوق جنوب شرق آسيا - لم يظهر اتجاه نزع الطابع الصيني

ال يواصل سوق آلات البناء في جنوب شرق آسيا تحقيق نمو قوي. تواصل دول مثل إندونيسيا وفيتنام تعزيز تطوير بنيتها التحتية، مما أدى إلى طلب قوي على أنواع مختلفة من آلات البناء. معدات مثل محملات 5-10 طن, حفارات 15 طنًا، وخلاطات الخرسانة متوفرة بكثرة. ورغم ما يُسمى بحركة "نزع الطابع الصيني"، فإن الأداء الحقيقي للسوق يُشير إلى أن هذا التوجه لم يعد قائمًا.

لا تزال المعدات الصينية، بفضل مزاياها المتمثلة في الأداء المتميز من حيث التكلفة وسرعة التسليم، تتمتع بمكانة تنافسية في سوق جنوب شرق آسيا. وتتمتع شركات آلات التطوير الصينية بالقدرة على توفير أسعار منخفضة مع ضمان جودة المنتج، بالإضافة إلى الاستجابة السريعة لطلبات العملاء وتسليم المعدات في الوقت المحدد لتلبية المواعيد النهائية الصعبة.

مع اشتداد المنافسة في السوق، أصبحت شبكات الموردين المحليين محور اهتمام جديد. ويتزايد عدد شركات معدات البناء الصينية التي تُقدم خدمات صيانة ما بعد البيع، وتوريد قطع الغيار، وخدمات أخرى محلية في جنوب شرق آسيا، بهدف تعزيز رضا العملاء وولائهم.

رابعًا: الاستجابة الاستراتيجية: كيف تستطيع الشركات التعامل مع التقلبات الإقليمية؟

في مواجهة تقلبات السوق في المناطق الخاصة، ترغب مجموعات معدات التطوير في اتباع تقنيات استباقية وعالية الجودة لتحقيق التنمية المستقرة.

فيما يتعلق بتمييز خطوط الإنتاج، يجب تطبيق إطلاقات المنتجات المُركزة بناءً على خصائص واحتياجات الأسواق الإقليمية المتميزة. يجب نشر المعدات الثقيلة في أسواق مثل أوروبا والولايات المتحدة، حيث يكون الطلب على المعدات الكبيرة مستقرًا للغاية، بينما تُنشر المعدات الخفيفة، مثل حفارات صغيرة من 1 إلى 3 أطنان و الرافعات الشوكية التي تعمل بالطاقة الكهربائية, يجب الترويج للعقارات في الأسواق الناشئة للتكيف مع متطلبات البناء ورغبات هذه الأسواق. كما يُعدّ تعديل وتيرة الإعلان في المناطق النائية أمرًا بالغ الأهمية. في الأسواق الناشئة مثل أمريكا اللاتينية وأفريقيا، تحتاج الشركات إلى التركيز على "السعر + التنوع" من خلال تقديم منتجات بأسعار تنافسية. محملات 5 أطنان و حفارات صغيرة مع مجموعة متنوعة من الملحقات لجذب العملاء. في الأسواق الأوروبية والأمريكية، يتعين على الوكالات التركيز على "السلامة البيئية + الخدمة"، مع تسليط الضوء على الأداء البيئي لمنتجاتها وخدمة ما بعد البيع المتميزة لتلبية المتطلبات الصارمة ورغبات المستهلكين في السوق المحلية.

تُعدّ العمليات المحلية مفتاح نجاح أي شركة في المناطق والأسواق النائية. ويتعين على الشركات تعزيز توطين خدمات ما بعد البيع وقطع الغيار وخدمات الشقق السكنية، وإنشاء نظام متكامل لخدمات التوصيل المحلية، وتحسين كفاءة وجودة خدمات التوصيل، وتعزيز استبقاء العملاء. بالإضافة إلى ذلك، يجب على الشركات الاستعداد لتداعيات الاقتصاد الكلي والكشف بعناية عن أهم معالم خططها الاستراتيجية في عدد من المناطق، مثل إمكانيات السوق التي يوفرها مشروع بناء العاصمة الإندونيسية الجديدة، وتأثير تعديلات الإعفاءات الضريبية على الصادرات الصينية على أعمال التصدير. ويتعين على هذه الشركات تعديل استراتيجياتها التجارية على الفور واغتنام فرص النمو.

V. الخاتمة: المرونة في مواجهة التقلبات الإقليمية هي مفتاح حيوية الشركة على المدى الطويل

وفي ظل التقلبات الإقليمية التي تشهدها سوق معدات التنمية العالمية، يتعين علينا أن ندرك حقاً أن تقلبات السوق لم تعد تعني انكماش السوق؛ بل إنها تتيح إمكانيات لإعادة تنظيم المساعدات والتكيف الهيكلي.

بالنسبة لشركات معدات البناء، يتطلب البقاء والتطور في بيئة السوق الحالية قدرات قوية على "التنبؤ الديناميكي وموازنة الأسواق المتعددة". التنبؤ الدقيق بتوجهات السوق وتعديل استراتيجيات الأعمال في الوقت المناسب. من خلال إنشاء وموازنة عدة أسواق، يمكن لهذه الشركات بناء احتياطي من السيولة لتخفيف المخاطر المرتبطة بالتقلبات في سوق واحد. ولا يمكن الحفاظ على حيوية طويلة الأجل وتحقيق تطور مستدام في ظل المنافسة الشرسة في السوق إلا من خلال تعزيز مرونتها باستمرار.